us germany tax treaty interest income

The Bundesfinanzhof Germanys federal tax court ruled in a recent decision that interest payments received by a US-resident partner on a loan to his German partnership can be taxed only in the United States in accordance with Article 111 of the US-Germany income tax treaty and are exempt from German taxation Bundesfinanzhof October 17 2007 IR 506 March 19. About Our International Tax Law Firm.

Budget 2020 Affordable Homes Get Tax Holiday Boost Tax Attorney Income Tax Return Income Tax

The United States has tax treaties with a number of foreign countries.

. The Protocol was signed Thursday in Berlin. Under these treaties residents not necessarily citizens of foreign countries are taxed at a reduced rate or are exempt from US taxes on certain items of income they receive from sources within the United States. 24 will be tax-free.

And bb the excise tax imposed on insurance premiums paid. Exemption on Your Tax Return. A In the United States.

Corporate recipients of dividend and interest income interest on convertible and profit-sharing bonds can apply for refund of the tax withheld over the corporation tax rate of 15 plus solidarity surcharge regardless of any further relief available under a treaty. The rate is 15 10 for Bulgaria. 2 Saving Clause and Exceptions.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital. Due to the Dutch dividend withholding tax exemption and the tax treaty. If the treaty does not cover a particular kind of income or if there is no treaty between your country and the United States.

For example interest earned on a US. 3 Relief From Double Taxation. These reduced rates and exemptions vary among countries.

If A is tax resident in Germany 76 of his pension will be taxed. Article 11 2 provides a definition of the term interest. The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it serves as an instrument for the abolition of double taxation on income earned by US and German residents who do business in both countries.

On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty. If you claim treaty benefits that override or modify any provision of the Internal Revenue Code and by claiming these benefits your tax is or might be reduced you must attach a fully completed Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701 b to your tax return. The existing taxes to which this Convention shall apply are.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. China Tax Treaties A quick guide to withholding tax rates of. The treaty has been updated and revised with the most recent version being 2006.

Interest for example or. A receives in the year 2018 his US social security pension for the first time. Return and a foreign tax credit can then be.

1 US-Germany Tax Treaty Explained. The new tax treaty replaces the treaty signed on 9 July 1962. US laws and is classified as a corporation for US tax purposes interest paid by a UK.

Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the United States from using the provisions of a tax treaty in order to avoid taxation of US. Most importantly for German investors in the United States the Protocol would eliminate the withholding. Generally only interest paid by banks to a resident is subject to a WHT.

Kimmitt and Barbara Hendricks Parliamentary Secretary of State Ministry of Finance signed a new Protocol to amend the existing bilateral income tax treaty concluded in 1989 between the two countries. Under the new tax treaty the following rates apply. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments.

The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. Aa the federal income taxes imposed by the Internal Revenue Code but excluding the accumulated earnings tax the personal holding company tax and social security taxes. The Germany-US double taxation agreement also contains provisions.

30 for Germany and Switzerland for. 98 rows Notes. 4 Income From Real Property.

The income must also be reported on the US. This percentage increases up to 2020 by 2 per year and from then on by 1. Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD.

Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. 9 Golding Golding. Germany and the United States have been engaged in treaty relations for many years.

The United States has entered into income tax treaties with more than 60 countries to avoid double taxation of income and to prevent tax evasion. WASHINGTON DC The Treasury Department today announced that Deputy Secretary Robert M. Bank account by an American residing in Germany will be taxable in Germany under the USGerman tax treaty.

Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in the other Contracting State. A new tax treaty between Israel and Germany is effective as of 1 January 2017 in force since 9 May 2016. Interest paid by US obligors in general Royalties Non-treaty.

Technical Explanation of the Convention. In the year 2040 the percentage will be 100. 8 Exchange of Information.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Doing Business In The United States Federal Tax Issues Pwc

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Interest Tax Shield Formula And Excel Calculator

United States Germany Income Tax Treaty Sf Tax Counsel

Form 8833 Tax Treaties Understanding Your Us Tax Return

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Taxation Of Income From Cross Border Interest

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

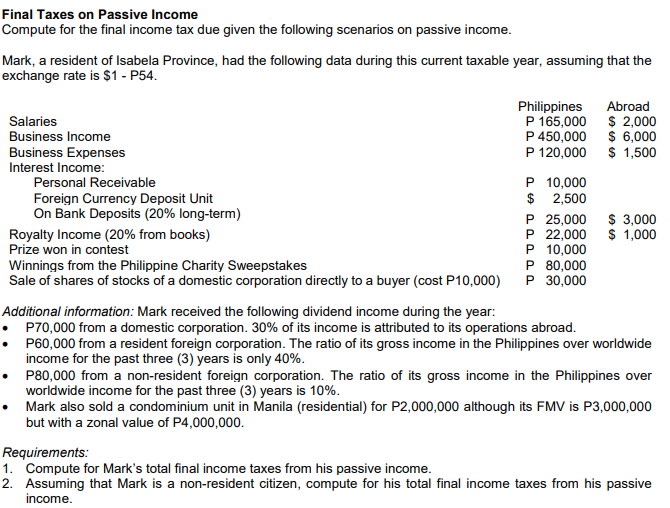

Answered Final Taxes On Passive Income Compute Bartleby

The 7 Best Languages For Business

Interest Tax Shield Formula And Excel Calculator

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

Completing Form 1040 And The Foreign Earned Income Tax Worksheet